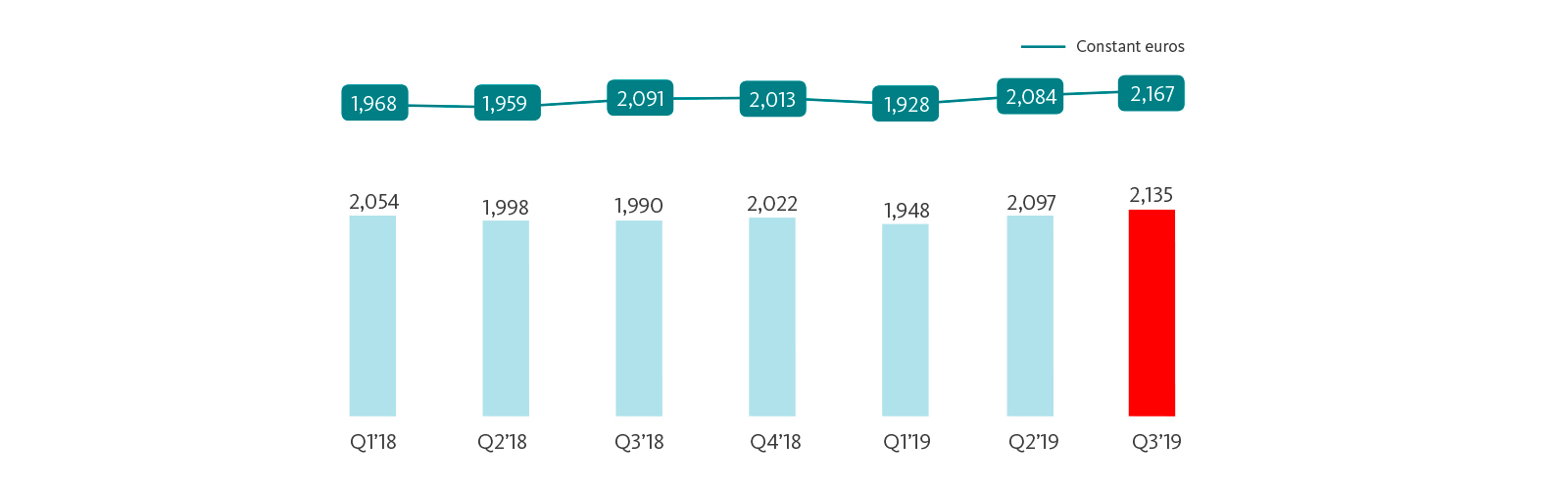

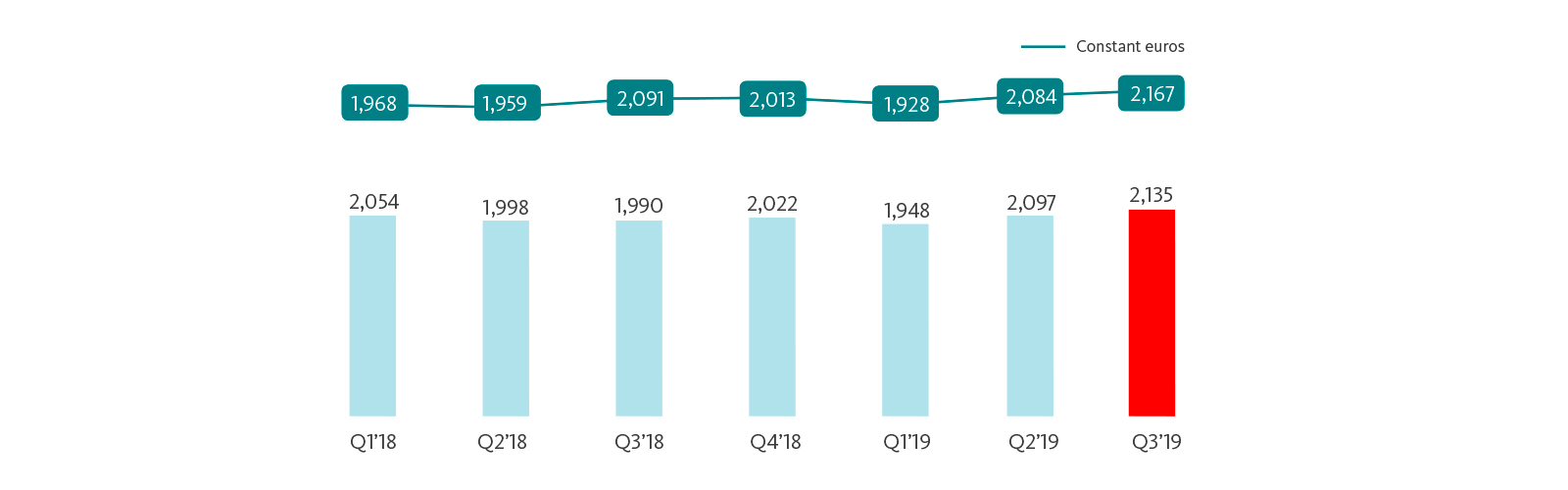

First nine months attributable profit of EUR 3,732 million, 35% lower year-on-year, after recording net charges that are outside the ordinary course performance of our business amounting to EUR 2,448 million in 2019 (mainly related to the review of goodwill ascribed to Santander UK an restructuring costs in Spain) and EUR 300 million in 2018.

Excluding these results, the underlying attributable profit was EUR 6,180 million, 2% more than in the same period of 2018 (+3% in constant euros), showing consistent profit quarter after quarter.

In a context of lower growth and interest rates, the underlying P&L trends remained solid: