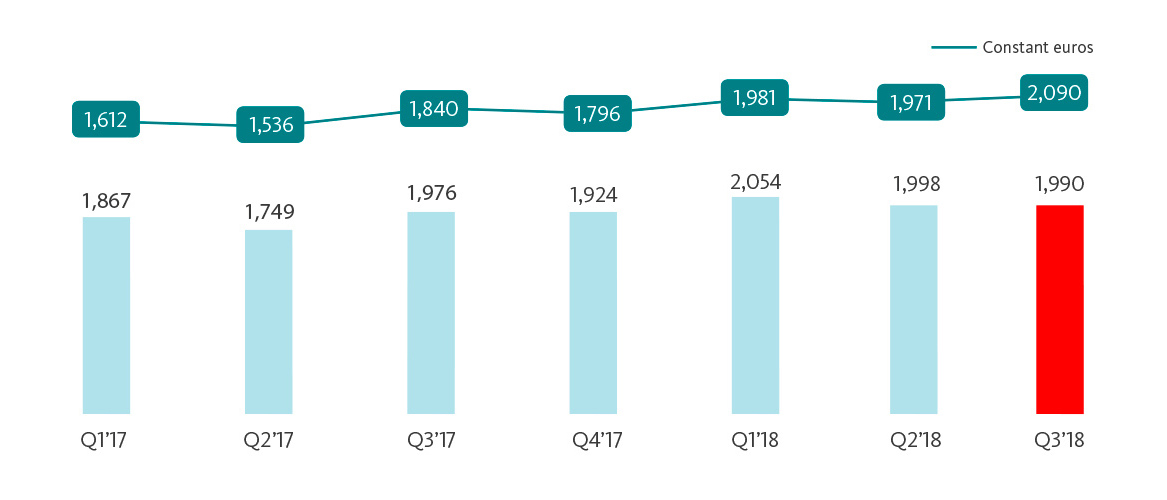

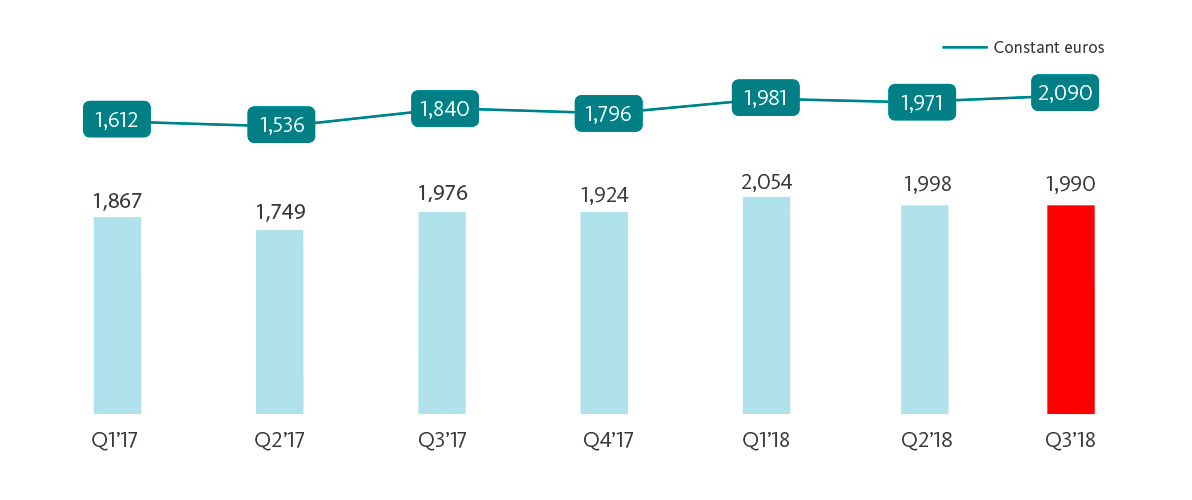

This figure includes non recurring items mainly associated with integrations (to a greater extent restructuring costs) net of tax impacts of EUR -300 million in 2018 and EUR -515 million in 2017. Excluding it, underlying profit was up 8% year-on-year at EUR 6,042 million (+21% in constant euros).

This evolution was positively affected by the incorporation of Banco Popular and the greater stake in Santander Asset Management and negatively by exchange rates and continued low interest rates in mature markets.

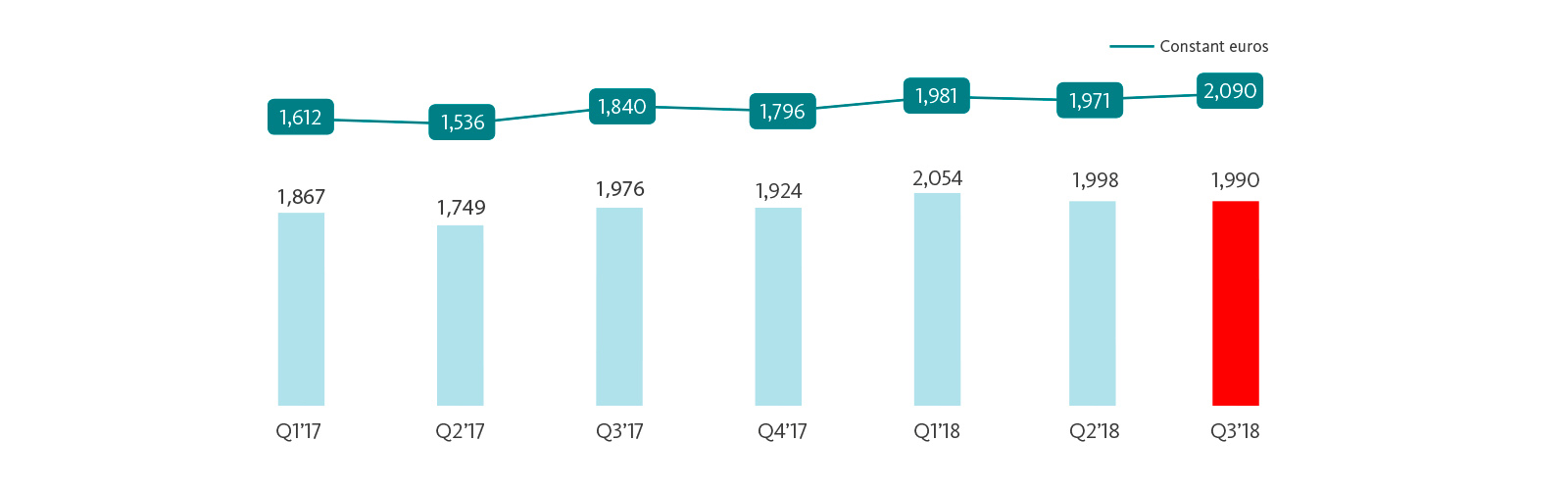

- In constant euros.