Santander kept up its business growth in almost all markets

Year-on-year comparison reflected a positive impact from Banco Popular’s integration last June and a negative impact of around six percentage points from the impact of exchange rates:

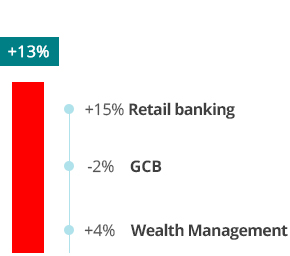

- Lending increased 13%, excluding the exchange rate impact, with growth in the main segments and in 9 of the 10 core units.

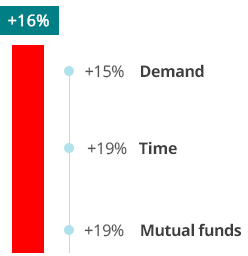

- Funds grew 16%, excluding the exchange rate impact, with rises in 8 of the 10 core units. Double-digit growth in demand and time deposits as well as in mutual funds.

Europe

| % Lending | % Funds |

|

|---|---|---|

| UK | 28% | 23% |

| SPAIN | 25% | 35% |

| SCF | 11% | 4% |

| PORTUGAL | 4% | 4% |

| POLAND | 3% | 3% |

| REST OF EUROPE | 2% | 1% |

North America

| % Lending | % Funds |

|

|---|---|---|

| USA | 8% | 7% |

| MEXICO | 3% | 4% |

South America

| % Lending | % Funds |

|

|---|---|---|

| BRAZIL | 9% | 12% |

| CHILE | 5% | 4% |

| ARGENTINA | 1% | 2% |

| REST OF AMERICAS | 1% | 1% |

% over operating areas. March 2018.

Activity

Mar'18/Mar'17. % change in constant euros

Gross loans and advances to customers excluding reverse repos

Customer deposits excluding repos plus mutual funds

BALANCE SHEET

MILLION EUROS| % change | |||

|---|---|---|---|

| Q1'18 | EUR | Constant EUR |

|

| Gross loans and advances to customers* | 856,197 | 7.0 | 12.7 |

| Customer deposits** | 724,772 | 10.6 | 15.9 |

| Mutual funds | 167,816 | 7.7 | 18.5 |

| Customer funds | 892,588 | 10.0 | 16.3 |

** Excluding repos.

Customers

The commercial transformation is driving growth in loyal and digital customers, which benefited from the incorporation of Banco Popular’s customers, with increased penetration of digital transactions and sales in the first quarter of 2018:

- The number of loyal customers increased by 3.3 million in the last 12 months, with growth in individual customers and in companies.

- The number of digital customers rose by 5.2 million over March 2017, underscoring the strength of the multichannel strategy.