Santander maintained its business growth across almost all its markets

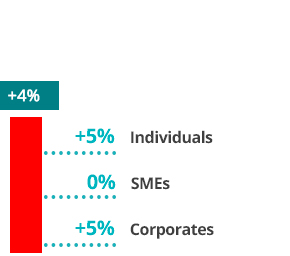

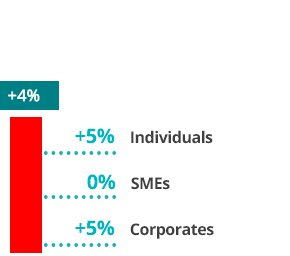

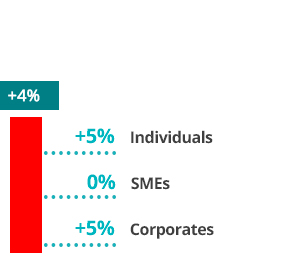

- Loans rose 4% year-on-year, both in euros and in constant euros, with growth in seven of the 10 core countries, particularly in developing markets (+12%).

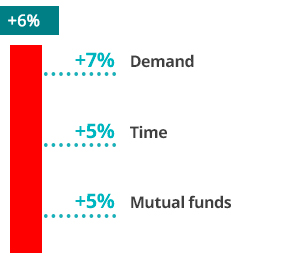

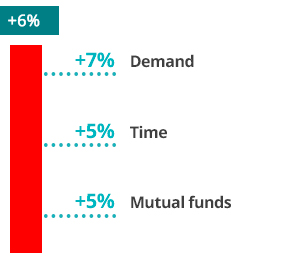

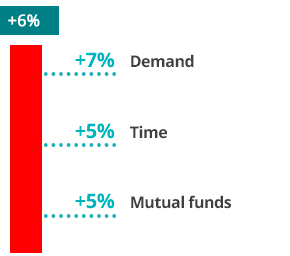

- Customer funds increased 7% year-on-year in euros. In constant euros up 6%, with rises in the 10 core units. Deposits (excluding repos) grew in all units and mutual funds in most of them.

Europe

| % Gross loans and advances* | % Funds | |

|---|---|---|

| UK | 26% | 22% |

| SPAIN | 22% | 33% |

| SCF | 11% | 4% |

| PORTUGAL | 4% | 4% |

| POLAND | 3% | 4% |

| OTHER EUROPE | 4% | 2% |

*Excl. Reverse repos

NORTH AMERICA

| % Gross loans and advances* | % Funds | |

|---|---|---|

| USA | 10% | 7% |

| MEXICO | 4% | 4% |

SOUTH AMERICA

| % Gross loans and advances* | % Funds | |

|---|---|---|

| BRAZIL | 9% | 13% |

| CHILE | 5% | 4% |

| ARGENTINA | 1% | 1% |

| URUGUAY AND ANDEAN REG. | 1% | 1% |

| Funds 1% |

% over operating areas. June 2019.

ACTIVITY

Jun-19 vs. Jun-18. % CHANGE IN CONSTANT EUROS

Gross loans and advances to customers excluding reverse repos.

Customer deposits excluding repos + mutual funds.

BALANCE SHEET

MILLION EUROS| % change vs. H1'18 | |||

|---|---|---|---|

| H1'19 | EUR | Constant EUR |

|

| Gross loans and advances to customers* | 898,908 | 4.2 | 4.2 |

| Customer deposits** | 779,510 | 6.6 | 6.7 |

| Mutual funds | 174,294 | 6.4 | 5.4 |

| Customer funds | 953,804 | 6.6 | 6.5 |

**Excluding repos.

Customers

The Group’s strategy is driving growth in loyal and digital customers:

- Further increase in loyal customers to more than 20 million in June 2019, 1.9 million more than at the end of June 2018 (+10%), with individuals up 11% and companies 7%.

- The faster pace of digitalisation is producing notable growth in digital customers, whose number increased by 6.4 million (+22%) in the 12 months since June 2018 to nearly 35 million. There was also strong growth in the number of online and mobile phone accesses in the first half to 3,725 million (+28% year-on-year) and in monetary and voluntary transactions to 1,062 million (+25%).