Santander kept up its business growth across almost all its markets

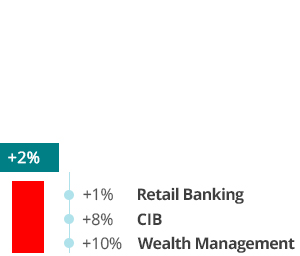

- Gross loans and advances increased year-on-year (excluding the exchange rate impact) in nine of the ten core units, especially in developing countries which grew 11%. Growth for the whole Group was 2%, affected by the Blackstone operation, reducing gross real estate loans from Banco Popular.

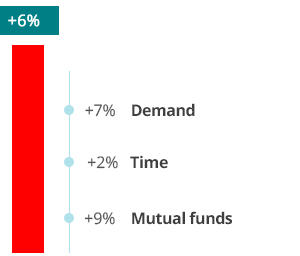

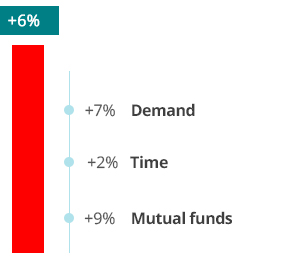

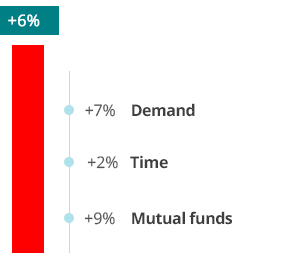

- Customer funds rose 6% year-on-year (excluding the exchange rate impact), with growth in eight of the ten core units. Rises in demand and time deposits and mutual funds.

Europe

| % Lending | % Funds | |

|---|---|---|

| UK | 28% | 23% |

| SPAIN | 25% | 36% |

| SCF | 11% | 4% |

| PORTUGAL | 4% | 4% |

| POLAND | 3% | 3% |

| REST OF EUROPE | 2% | 1% |

NORTH AMERICA

| % Lending | % Funds | |

|---|---|---|

| USA | 9% | 7% |

| MEXICO | 3% | 4% |

SOUTH AMERICA

| % Lending | % Funds | |

|---|---|---|

| BRAZIL | 8% | 12% |

| CHILE | 5% | 4% |

| ARGENTINA | 1% | 1% |

| REST OF AMERICAS | 1% | 1% |

% over operating areas. June 2018.

ACTIVITY

Jun'18 versus Jun'17. % CHANGE IN CONSTANT EUROS

Gross loans and advances to customers excluding reverse repos*.

Customer deposits excluding repos + mutual funds.

*Excluding the effect of Blackstone transaction: +3%.

BALANCE SHEET

MILLION EUROS| % change | |||

|---|---|---|---|

| H1'18 | EUR | Constant EUR |

|

| Gross loans and advances to customers* | 862,885 | (0.9) | 1.8 |

| Customer deposits** | 731,238 | 2.4 | 5.3 |

| Mutual funds | 163,790 | 1.4 | 9.1 |

| Customer funds | 895,028 | 2.3 | 6.0 |

**Excluding repos.

Customers

The commercial transformation is driving growth in loyal and digital customers (benefited from the incorporation of Banco Popular’s customers):

- The number of loyal customers continued to rise and was 2.8 million higher than in June 2017 (+17%), with individuals as well as companies rising. The strategy remains focused on loyalty, which is reflected in increased commercial activity.

- The number of digital customers rose by 5.3 million (+23%) in the last 12 months, underscoring the strength of our multichannel strategy. Digital customer penetration and the use of mobile devices is growing notably.