Ramiro Mato joins Banco Santander's Board and Executive Committee

- Matías Rodríguez Inciarte, named Chairman of Santander Universities and Vice Chairman of Universia and Isabel Tocino, appointed Vice Chairman of Santander Spain and Chairman of Banco Pastor, leave the board of Banco Santander.

- The Board agrees to allocate 600 million euros as a goodwill impairment and maintains its goal to increase dividend per share in 2017 and 2018; and earnings per share in 2017 and 2018, the latter by double digits.

Madrid, 28 November 2017 – PRESS RELEASE

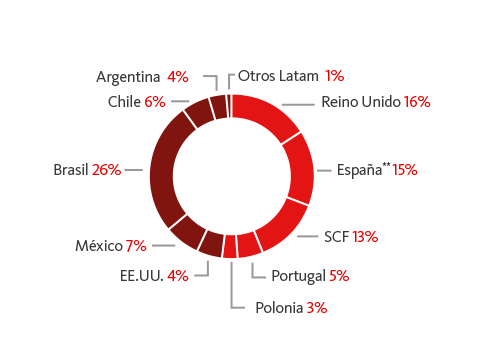

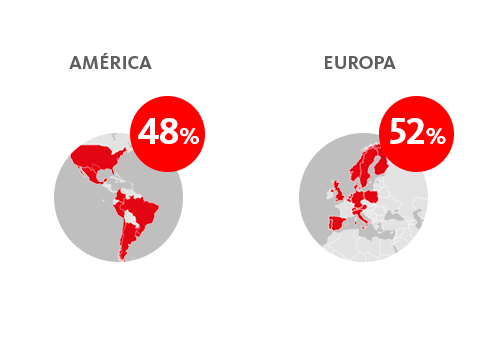

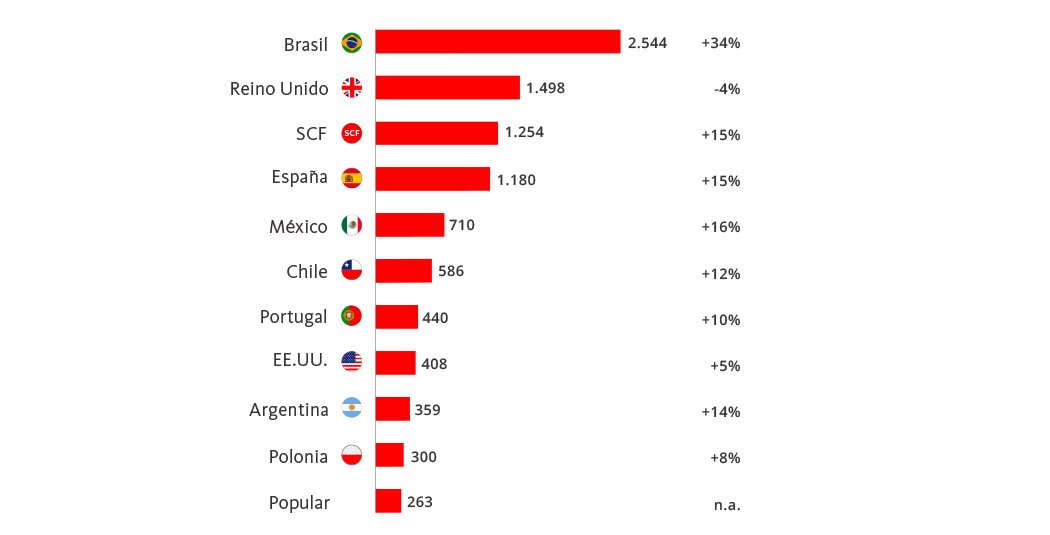

Banco Santander's board of directors met today in Brazil, a country that contributes 26% of the Group's profits. During the meeting, the Board approved changes to its composition, as well as adjustments to the goodwill of the Group. The review of goodwill has resulted in an impairment of 600 million euros, which will not impact capital ratios. Despite these adjustments, Banco Santander maintains its goal to increase dividend per share in 2017 and 2018; and earnings per share in 2017 and 2018, the latter by double digits.

The Board has agreed to appoint Ramiro Mato as Independent Director, following the proposal made by the Appointments Committee and after receiving regulatory approval. He will also join the Board´s executive committee, as well as the Audit and the Risk Supervision, Regulation and Compliance Committees. His appointment will be subject to ratification at the next annual general meeting of Santander's shareholders.

Matías Rodríguez Inciarte and Isabel Tocino will leave the board of directors of Banco Santander to take on new roles. Matías Rodríguez Inciarte will become the Chairman of Santander Universities, replacing Rodrigo Echenique Gordillo, and Vice Chairman of Universia, reporting directly to Ana Botín. The Director of Santander Universities, Javier Roglá, will continue to have a double reporting line, as he has to date, both to the Chairman of Santander Universities and to the Group Executive Chairman, Ana Botín, for the development of strategic projects.

Once regulatory approval has been obtained, Isabel Tocino will become Vice Chairman of the Board of Santander Spain and Chairman of Banco Pastor, an entity that became part of the Santander Group as of 7th June 2017, as a result of the acquisition of Banco Popular.

As a result of these changes, Banco Santander's board of directors will have 14 members, of which the majority (eight) are independent. The board of Santander is diverse in gender (more than a third are women), national origin (Spanish, British, American and Mexican) and has broad sector representation (finance, distribution, technology, infrastructure and academia).

Ana Botín, Executive Chairman of Banco Santander, said: “Ramiro Mato's membership of the board and its committees will add considerable value thanks to his broad finance and international banking management experience.” Ana Botin also thanked Matías Rodríguez Inciarte and Isabel Tocino for their contribution to the board. “In his extensive career, Matías has played an important role in the success story of the Bank. We will continue to draw on his expertise in Santander Universities, our flagship programme in helping communities prosper.” Ana Botín added “I am sure that Isabel's strength and dedication will be crucial for all of Santander Spain, especially in her new role as Chairman of Banco Pastor, which has an extensive presence in Galicia.”

Ramiro Mato (Madrid, 1952), graduated in Economics from the Complutense University of Madrid. He began working in banking in 1980 and, after carrying out several different roles in the public group Argentaria, joined BNP Paribas in 1993, where he has been serving as its highest ranking executive in Spain and Portugal for the last 20 years.

Review of goodwill

In accordance with its annual engagement plan and accounting standards, the Bank has carried out a review of its goodwill. Accordingly, an impairment will be taken for approximately 600 million euros, net of taxes, of which 500 million are a result of the review of the Group's investment in Santander Consumer USA Holdings Inc (SCUSA). The impairment for SCUSA is driven by a reduction in the company's earnings relative to prior years.

The impairment will be recognised in the Group's consolidated results for the fourth quarter of 2017 and will not have an impact on the Group's CET1 since goodwill is excluded from the CET1 calculation. At the close of the third quarter, Banco Santander's fully loaded CET1 was 10.80%.

Furthermore, Santander has updated the public information regarding two previously announced transactions that have an impact in the fourth quarter of 2017. On 21 November 2017 the Bank and its partners closed the sale of 100% of the share capital of Allfunds Bank, S.A., a transaction that forms part of the agreement reached on 16 November 2016 by the Bank to acquire from Warburg Pincus and General Atlantic the 50% of Santander Asset Management (SAM) that the Bank does not own. It is expected that this transaction will be completed before year-end.

The combined effect of the two transactions in the fourth quarter of 2017 will consume nine basis points of capital (CET1), including the effect of the net gain of 300 million euros obtained from the sale of the investment in Allfunds Bank.

Banco Santander reiterates its goal to increase dividend per share in 2017 and 2018; and earnings per share in 2017 and in 2018, the latter by double digits.