QUARTERLY SHAREHOLDER

REPORT

October - December

2016

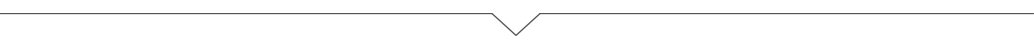

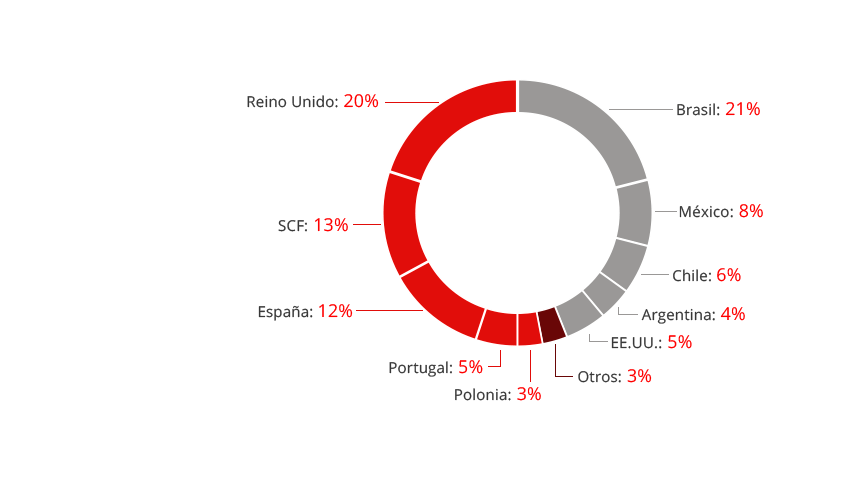

We have earned the loyalty of a further 1.4 million customers, serving 125 million people and

businesses across Europe and the Americas and increasing lending by 2%.

Going forward, we have many opportunities for profitable growth in Europe and the Americas, in an

environment we anticipate will be volatile but generally better than 2016."

ANA BOTÍN, GROUP EXECUTIVE CHAIRMAN OF BANCO SANTANDER