Santander increases profitability target for 2018

Ana Botín announces improved outlook at the Group’s Strategy Update in New York.

New York, 10 October 2017 - PRESS RELEASE

Banco Santander has today increased its return on tangible equity (ROTE) target for 2018. The target has increased from 11% to over 11.5% due to an improving economic outlook in a number of the Group’s core markets.

The change in target has been confirmed at Banco Santander’s 2017 ‘Group Strategy Update’ which has taken place today at the New York Stock Exchange. The event, attended by close to 200 analysts and investors, has been held in New York for the first time.

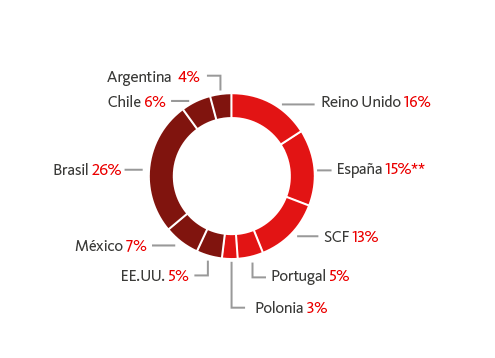

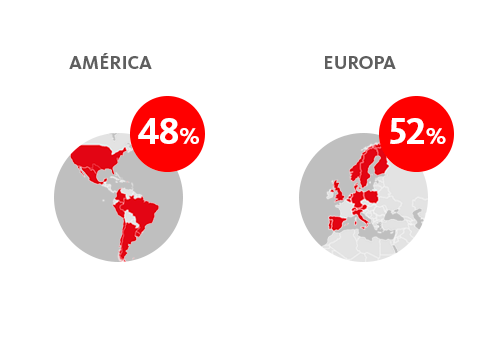

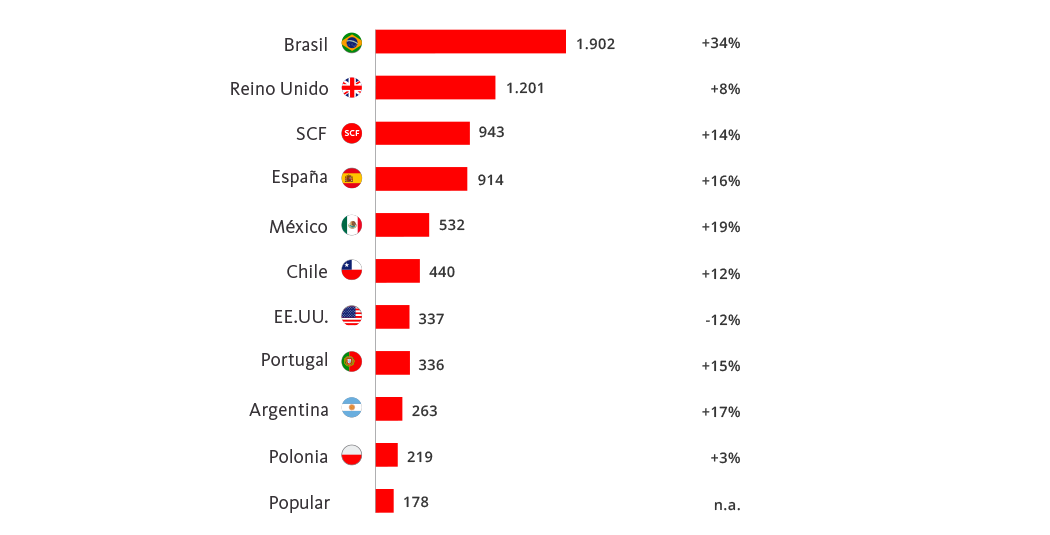

Over the past twelve months, shares in Banco Santander S.A. have outperformed the market significantly, increasing by 54.3% during the period compared to a 35.8% increase in the Stoxx Banks Index. In July 2017 the Bank announced a 24% increase in attributable profit for the first half of 2017, driven in part by particularly strong performance in Latin America as well as improvements in Spain and robust performance in the UK.

Ana Botín, Banco Santander Executive Chairman, said: “In the last 12 months we have made significant progress in earning customer loyalty and improving the quality of our business. We continue to see excellent growth in Latin America as well as positive trends across both Europe and the US. In the UK, while GDP growth has slowed, performance has been better than we had expected. As a result we have increased our profitability targets for 2018”.

During the strategy update Santander reiterated all its remaining targets for 2018, including targets to reach double digit growth in Earnings Per Share (EPS) by 2018, and grow total and cash Dividend per Share (DPS), and Tangible Net Asset Value per share annually (see appendix).

José Antonio Álvarez, Group Chief Executive Officer, said: “Our strategy is working and we continue to deliver on the commitments made to our shareholders. We are increasing loyal customers and progressing well with our digital transformation – maintaining our position among the most profitable and efficient banks in the world”.

Appendix – Ahead of plan on all commitments

Important Information: Banco Santander, S.A. ("Santander") cautions that this press release contains statements that constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RORAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”, “future” and similar expressions. These forward-looking statements are found in various places throughout this press release and include, without limitation, statements concerning our future business development and economic performance and our shareholder remuneration policy. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a

number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) general market, macroeconomic, industry, governmental and regulatory trends; (2) movements in local and international securities markets, currency exchange rates and interest rates; (3) competitive pressures; (4) technological developments; and (5) changes in the financial position or credit worthiness of our customers, obligors and counterparties. Numerous factors, including those reflected in the Annual Report on Form 20-F filed with the Securities and Exchange Commission of the United States of America (the “Form 20-F” and the “SEC”, respectively) on March 31, 2017 and the Periodic Report on Form 6-K for the six months ended June 30, 2017 filed with the SEC on October 5, 2017 (the “Form 6-K”) –under “Key Information-Risk Factors”- and in the Documento de Registro de

Acciones filed with the Spanish Securities Market Commission (the “CNMV”) –under “Factores de Riesgo”- could affect the future results of Santander and could result in other results deviating materially from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements.

Forward-looking statements speak only as of the date of this press release and are based on the knowledge,

information available and views taken on such date; such knowledge, information and views may change at any time. Santander does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

The information contained in this press release is subject to, and must be read in conjunction with, all other

publicly available information, including, where relevant any fuller disclosure document published by Santander. Any person at any time acquiring securities must do so only on the basis of such person's own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in the press release. No investment activity should be undertaken on the basis of the information contained in this press release. In making this press release available, Santander gives no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever.

Neither this press release nor any of the information contained therein constitutes an offer to sell or the

solicitation of an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this press release is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000.

Note: Statements as to historical performance or financial accretion are not intended to mean that future

performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior year. Nothing in this press release should be construed as a profit forecast.