QUARTERLY SHAREHOLDER

REPORT

APRIL-JUNE

2016

ANA BOTÍN, GROUP EXECUTIVE CHAIRMAN OF BANCO SANTANDER

SHARE ACTIVITY

The Santander share closed at EUR 3.43 per share at the end of the first half of 2016.

Key share price information

OPENING

(31/12/2015)

EUR 4.56

CLOSING

(30/06/2016)

EUR 3.43

MINIMUM

(24/06/2016)

EUR 3.15

MAXIMUM

(27/04/2016)

EUR 4.69

Key factors shaping share price performance

Market performance in the first half was marked by high volatility caused by factors such as uncertainties over the performance of the Chinese economy and the global impact of these uncertainties, commodity price performance, in addition to concerns over the solvency of the financial sector, interest rates policies and the stimulus measures applied by different central banks. The vote in favour of the UK's departure from the European Union in the referendum held in the last week of June has caused a great deal of tension.

At the date of publication of this report, 22 July, the Santander share was trading at 3.88 euros, marking a rise of 13.1% in the month and a decline of 14.9% in the year, compared to the DJ Stoxx Banks and MSCI World Banks indices (-26.8% and -8.3%, respectively).

EUR 4.48

SAN target price

84.2%

of analysts have a buy

or hold recommendation on the share

Source: Bloomberg at 30 June.

International ranking by market capitalisation

At 22 July 2016, Santander was the number 1 bank in the euro area by market cap, with EUR 55,977 million.

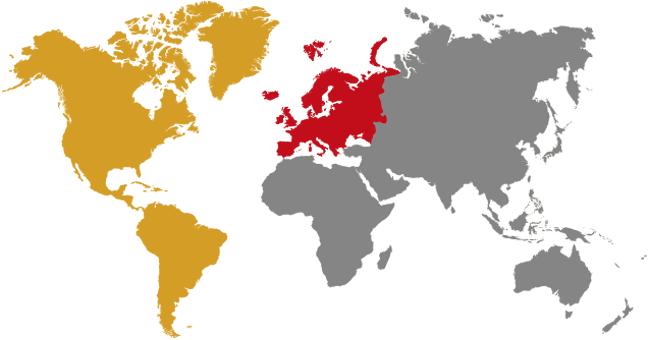

SHAREHOLDER BASE

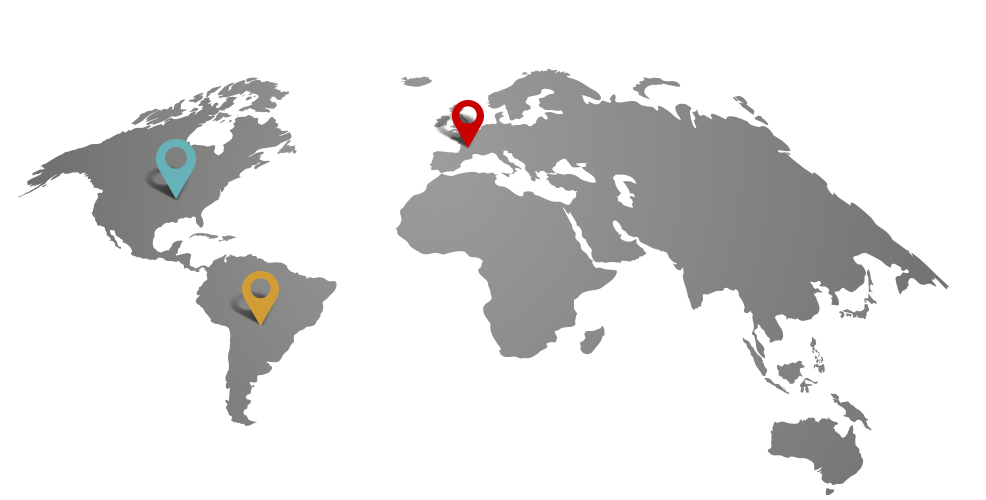

Banco Santander has 3.8 million shareholders, located mainly across Europe and the Americas.

Number

of shareholders

221,643

more shareholders in the six month period

Capital

stock ownership 30 June 2016

Institutional

investors

53.39%

The board

of directors

1.26%

Individuals

45.35%

Geographical distribution of share capital 30 June 2016

Europe

82.59%

Americas

17.12%

Rest of

the world

0.29%

DIVIDENDS

Total shareholder remuneration charged to 2016 is expected to reach EUR 21 cents per share.

This amount would be paid through four dividends, three in cash (a total of EUR 16.5 cents per share) and one though the Santander Scrip Dividend Scheme (EUR 4.5 cents per share).

Tentative dividend payment dates:

1st

Dividend

Payment tentatively on

1 August 2016,

in cash.

EUR 5.5 cents/share.

2nd

Dividend

Payment tentatively in November 2016 through the Santander Scrip Dividend Scheme, allowing shareholders to choose between receiving cash or shares.

EUR 4.5 cents/share.

3rd

Dividend

Payment tentatively in

February 2017,

in cash.

Amount pending Board approval

4th

Dividend

Payment tentatively in

May 2017,

in cash.

Amount pending Board approval

Dividend yield: 5.03%*

*Last two dividends plus two announced / average share price in the first half of 2016.

This remuneration would imply:

An increase in the total dividend of 5%

And in the cash dividend of around 10%

RESULTS

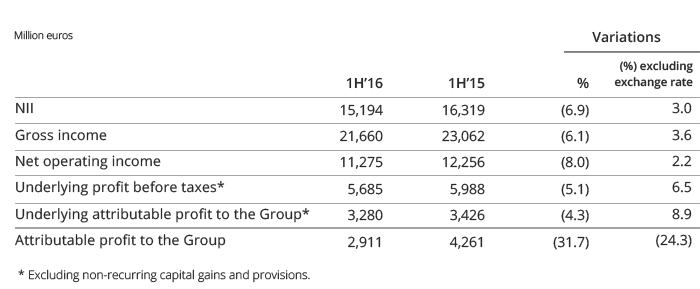

Attributable profit for the first half of 2016 was 2,911 million euros, 32% less than in the same period of 2015. Stripping out non-recurring results posted in both periods, underlying profit to 30 June is 3,280 million euros, a 9% increase on the year ago-figure (on a currency-neutral basis) due to:

Solid commercial revenues, driven by NII and fees.

Virtually stable expenses, adjusted for inflation and no change to the scope of consolidation.

Slight increase in provisions after declining in the quarter.

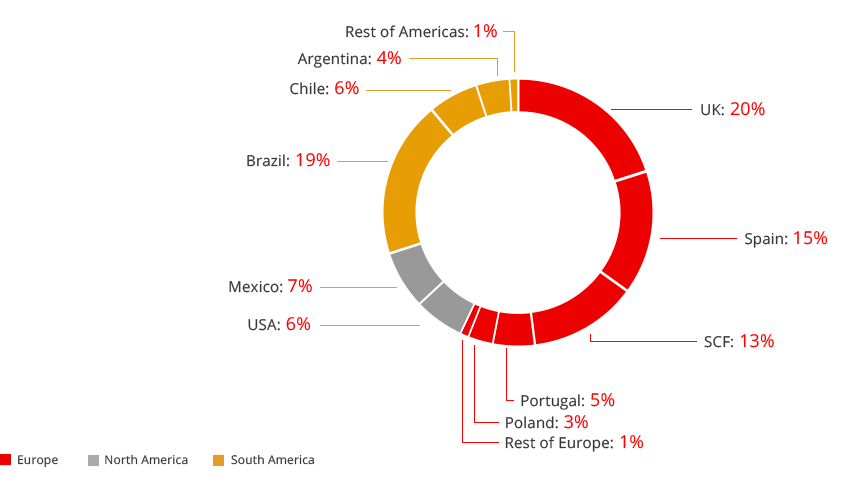

Business segments. 1H'16 underlying attributable profit

Good earnings diversification between Europe and Americas.

Percentage excluding the Corporate Centre and the Real Estate Activity in Spain.

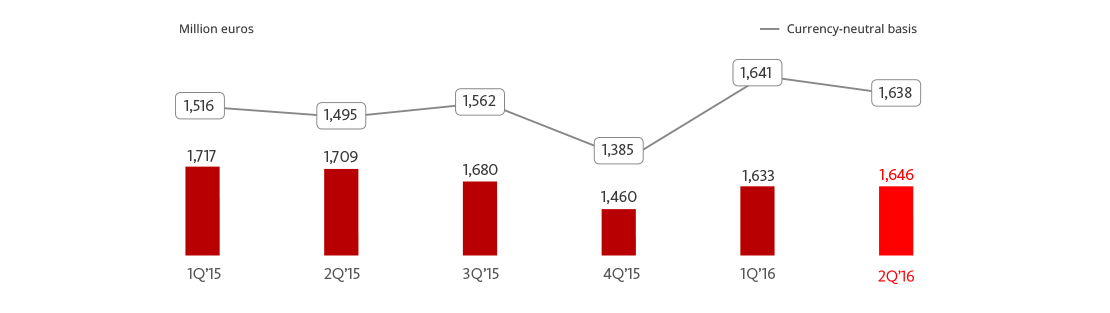

Underlying attributable profit to the Group

Note: excluding non-recurring net capital gains and provisions in 2Q’15, 4Q’15 and 2Q’16.

More information

BALANCE SHEET

Total funds managed and marketed at 30 June 2016 amounted to 1,517,386 million euros, of which 1,342,906 million related to assets on the balance sheet and the rest mutual funds, pension funds and managed portfolios

In a complex environment, we continued to expand our activity, mainly in emerging countries

| % over operating areas. June 2016 |

| % Lending | % Funds | |

|

||

|

32% | 28% |

|

20% | 28% |

|

10% | 4% |

|

4% | 4% |

|

2% | 3% |

|

2% | 1% |

|

||

|

11% | 9% |

|

4% | 5% |

|

||

|

9% | 12% |

|

5% | 4% |

|

1% | 1% |

|

0.5% | 1% |

| % over operating areas. June 2016 |

| % Lending | % Funds | |

|

||

|

32% | 28% |

|

20% | 28% |

|

10% | 4% |

|

4% | 4% |

|

2% | 3% |

|

2% | 1% |

|

||

|

11% | 9% |

|

4% | 5% |

|

||

|

9% | 12% |

|

5% | 4% |

|

1% | 1% |

|

0.5% | 1% |

More information

Activity

Loyal customers

(million)

Retail loyal customers

(million)

SMEs & corporate loyal customers (million)

Digital customers

(million)

NEWS

Banco Santander reiterates its business and financial targets for 2016.

The objectives announced at the 2015 Investor Day are unchanged. These include: capital generation, EPS growth, increase in tangible capital per share and dividend growth.Banco Santander will be holding a Group Strategy Update on 30 September in London

The event will consist of plenary meetings with senior management.Santander named Best Bank in the World for SMEs by Euromoney

Euromoney highlighted Santander’s global and market specific support for small and medium-sized enterprises (SMEs).Santander launches contactless wristband in collaboration with MasterCard

Wristband now available to Banco Santander customers and allows them to pay at all establishments which accept contactless payment.Santander InnoVentures announces investment in digital identity verification firm Socure

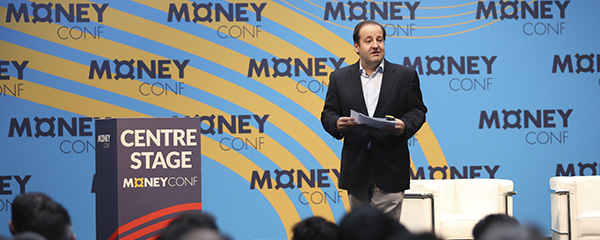

New York-based provider of real-time digital identity verification solutions becomes Santander InnoVentures’ ninth portfolio investment.Santander Spain increases its offer of mixed funds with two new product ranges:

Santander Evolución and Santander Generación.Ana Botín: “Society wants us to come to agreements so that, through education, we can build a better and fairer future for everyone”.”

The Executive Chairman of Banco Santander issued this statement during her presentation at the Universia Annual General Meeting.More information

Keep up to date with the Group at www.santander.com.