QUARTERLY SHAREHOLDER REPORT

OCTOBER - DECEMBER

2015

OCTOBER - DECEMBER

2015

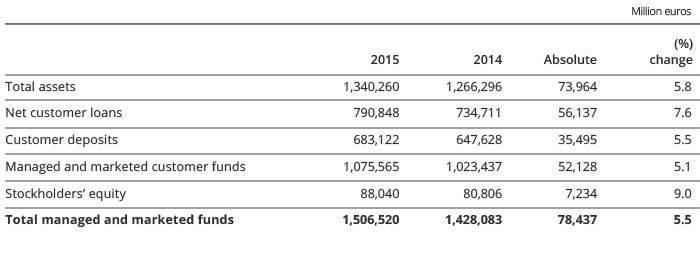

"In 2015, we have delivered ahead of plan in the right way, growing revenues by improving

customer service and increasing loyal and digital customers."

ANA BOTÍN, GROUP EXECUTIVE CHAIRMAN, BANCO SANTANDER