QUARTERLY SHAREHOLDER

REPORT

JANUARY-MARCH

2016

Santander Q1 profit reaches EUR 1,633 million,

5% less year‐on‐year and up 8% excluding FX impact.

increasing the cash dividend per share by 10% and total dividend by 5%."

ANA BOTÍN, GROUP EXECUTIVE CHAIRMAN OF BANCO SANTANDER

SHARE ACTIVITY

Santander’s share price ended the first quarter of 2016 at EUR 3.87 per share.

Key share price information

OPENING

(31/12/2015)

EUR

4.56

MAXIMUM

(14/03/2016)

EUR

4.57

MINIMUM

(11/02/2016)

EUR

3.31

CLOSING

(31/03/2016)

EUR

3.87

Key factors shaping share price performance

Markets were extremely volatile in the year's first quarter due mainly to concerns surrounding the Chinese economy, trends in commodity prices (above all oil prices, which hit 12-year lows below USD 30/bbl), doubts surrounding the financial sector’s solvency and question marks surrounding the interest rate policies and stimulus measures central banks would adopt.

* Source: Bloomberg, at 31 March.

Santander's share price at the date of this report was EUR 4.53, up 16.8% in the month and down 0.7% YTD, compared to -13.9% and -3.2% by the DJ Stoxx Banks and MSCI World Banks, respectively.

International ranking by market capitalisation

At the end of the quarter, Banco Santander was the number 1 bank in the euro area by market cap, with EUR 55,919 million.

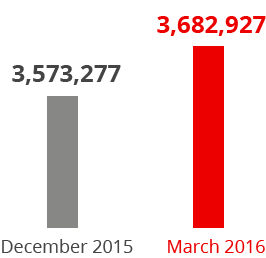

SHAREHOLDER BASE

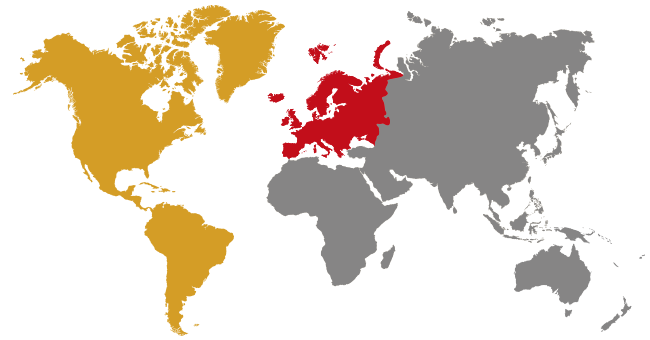

Banco Santander has 3.7 million shareholders, located mainly across Europe and the Americas.

Number

of shareholders

109,650

more shareholders in the quarter

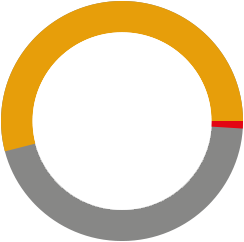

Capital

stock ownership 31 March 2016

Institutional investors

53.57%

The board of directors

1.26%

Individuals

45.17%

Geographical distribution of share capital 31 March 2016

Europe

82.54%

Americas

16.82%

Rest of the world

0.64%

DIVIDENDS

DIVIDENDS AGAINST 2015 PROFIT

Total shareholder remuneration charged to 2015 profit amounts to EUR 20 cents per share.

This amount is divided into four dividend payments, of which three have already been paid. The fourth will scheduled to be paid in May.

1st

payment

Paid in August 2015 as a cash dividend.

EUR 5 cents per share.

2nd

payment

Paid in November 2015 through the Santander Scrip Dividend Scheme.

EUR 5 cents per share.

3rd

payment

Paid in February 2016 as a cash dividend.

EUR 5 cents per share.

4th

payment

Scheduled for May 2016 as a cash dividend.

EUR 5 cents per share.

Dividend yield: 5,1%*

*Remuneration against 2015 profit/average share price in 1Q'16

DIVIDENDS AGAINST 2016 PROFIT

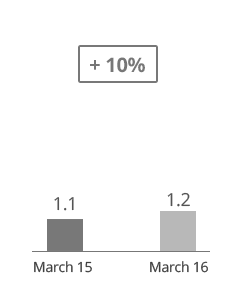

Total shareholder remuneration charged to 2016 profit is estimated at EUR 21 cents per share.

This amount entails four dividend payments, of which three will be in cash (for a total of EUR 16.5 cents per share) and one would be under the Santander Scrip Dividend scheme (of EUR 4.5 cents per share). This remuneration implies:

- AN INCREASE IN

THE TOTAL DIVIDEND

OF 5%

- AND IN THE CASH

DIVIDEND OF AROUND

10%

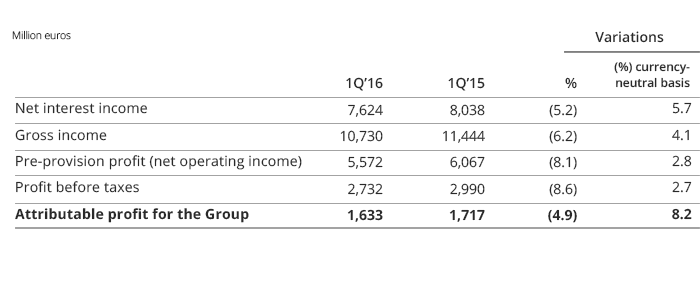

RESULTS

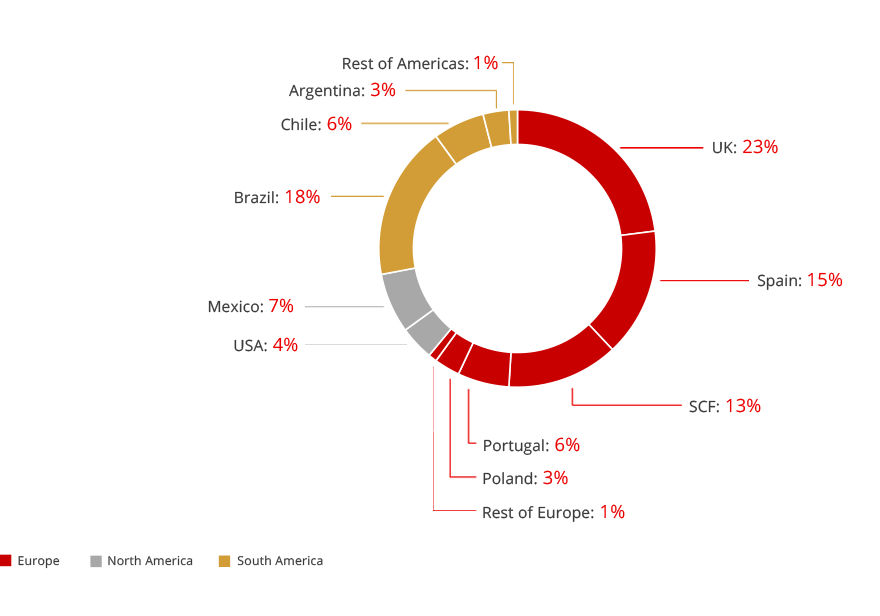

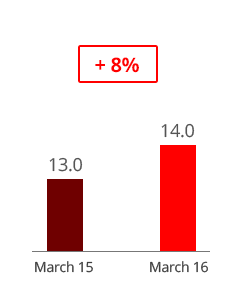

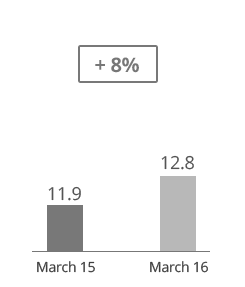

Attributable profit of EUR 1,633 million, 5% less than in the first quarter of 2015. Negative impact of exchange rates (+8% on a currency-neutral basis):

Solid commercial revenues, fuelled by net interest income as well as fee income.

Cost almost stable in real terms and on a like-for-like basis.

Provisions were higher year-on-year, but stable over the last two quarters.

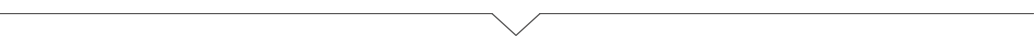

Business segments. 1Q’16 attributable profit

Good earnings diversification between Europe and Americas.

Percentage excluding the Corporate Centre and the Real Estate Activity in Spain.

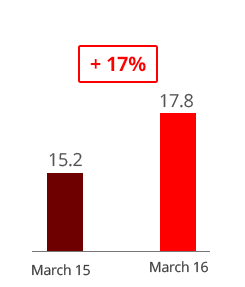

Underlying attributable profit to the Group

Note: excluding non-recurring net capital gains and provisions in 2Q'15 and 4Q'15.

More information

BALANCE SHEET

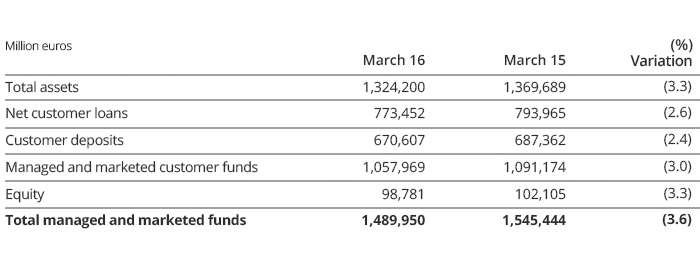

Total business managed and marketed at 1Q'2016 stood at 1,489,950 million euros, of which EUR 1,324,200 million related to assets on the balance sheet and the rest mutual funds, pension funds and managed portfolios.

Growth in lending to individuals and SMEs, as well as in demand deposits, underscores the efforts to boost customer loyalty

On a currency-neutral basis:

- Funds increased 4% year-on-year due to demand deposits. Growth in nine of the 10 core units.

| % over operating areas. March 2016. |

% lending |

% funds |

|

|

||

|

33% | 28% |

|

20% | 29% |

|

10% | 4% |

|

4% | 4% |

|

3% | 3% |

|

2% | 1% |

|

||

|

8% | 11% |

|

4% | 4% |

|

1% | 1% |

|

0.5% | 1% |

|

||

|

11% | 9% |

|

4% | 5% |

| % sobre áreas operativas. Marzo 2016 |

% créditos |

% recursos |

|

|

||

|

33% | 28% |

|

20% | 29% |

|

10% | 4% |

|

4% | 4% |

|

3% | 3% |

|

2% | 1% |

|

||

|

8% | 11% |

|

4% | 4% |

|

1% | 1% |

|

0,5% | 1% |

|

||

|

11% | 9% |

|

4% | 5% |

More information

Activity

Loyal

customers

(million)

Retail loyal

customers

(million)

SMEs & corporate loyal

customers

(million)

Digital

customers

(million)

NEWS

2016 Annual General Meeting

Ana Botín: “The board intends to increase the dividend per share by 5% for 2016.”Online Annual Report 2015

Consult the Annual Report for a quick view and information on the Group's financial highlights and the share price in the year.University

Banco Santander will give out over 36,000 study, mobility and internships grants in 2016.More information

Keep up to date with the Group at www.santander.com